Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

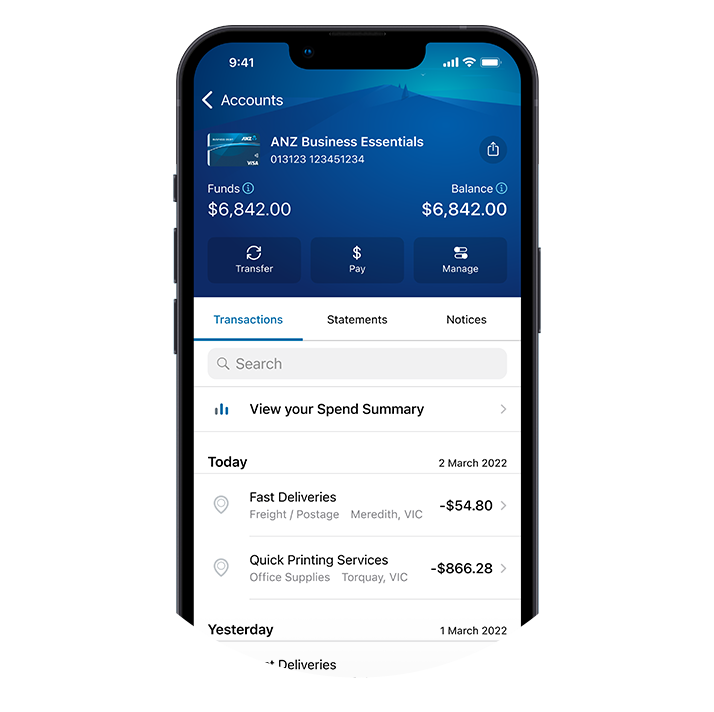

Untangle your business finances. Get your new business transaction account set up in minutes with the ANZ Appdisclaimer.

It could help you save time on admin and give you a better picture of where your business is at.

Sole traders and single director company owners can open a business transaction account in the ANZ App. You only need your driver's licence or passport and an ABN to get going. We'll verify your identity online and get you set up quickly. Plus, you can get real-time Push Notifications for incoming and outgoing payments, so you’ll know who has paid you and how much you’ve been paid or when you’ve paid others.

See your home loan interest rate, repayment amount and frequency, and other details. A progress bar shows you how much you’ve paid off at a glance.

The ANZ App supports Dynamic Type, which let you change the font size. Hear your balances and make transfers or payments with VoiceOver and TalkBack.

Easily apply for new accounts without needing to visit a branch. You can use the ANZ App to open a business transaction, personal transaction or personal savings account.

Our goals featuredisclaimer in the ANZ App can help you stay on track to get to your goal.

Find answers to common questions, message us or call in the ANZ App to get support. Log in to the ANZ App, tap on Support then Message us.

Head to ‘For You’ in the ANZ App to view the latest cashback offers.disclaimer

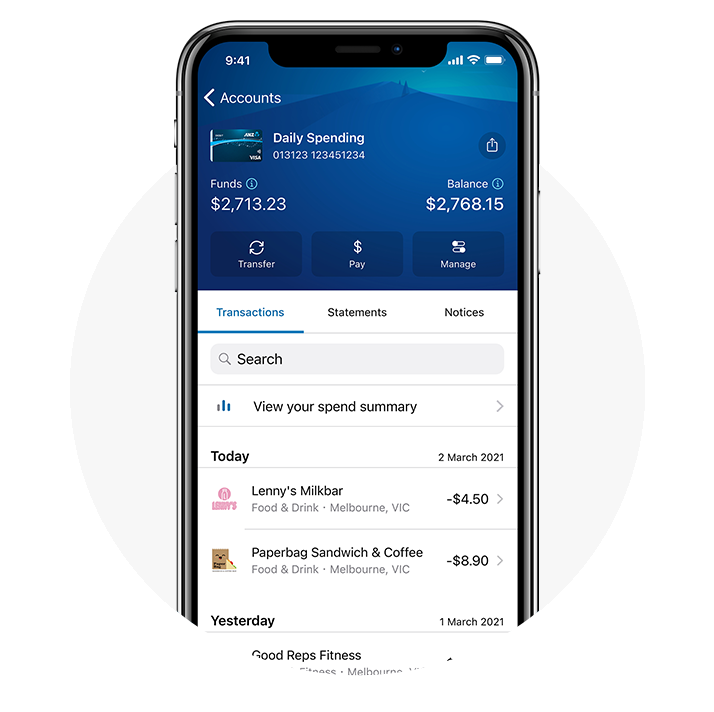

Join over 4 million personal and business users who are using the app to get on top of their money. See your spending by merchant or category, make payments in as little as 60 seconds with PayID,disclaimertemporarily block and unblock your card, and so much more.

|

Don't have the ANZ App for iPhone? |

|

Don't have the ANZ App for android? |

![]()

The ANZ App is provided by Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Super and Insurance (if available) are not provided by ANZ but entities which are not banks. ANZ does not guarantee them. This information is general in nature only and does not take into account your personal objectives, financial situation or needs. ANZ recommends that you read the ANZ App Terms and Conditions available here for iOS (PDF) and here for Android (PDF) and consider if this service is appropriate to you prior to making a decision to acquire or use the ANZ App.

ANZ App for Android is only available on Google Play™. ANZ App for iPhone is only available from the App Store.

Apple, Apple Pay, Apple Watch, Face ID, iPad, iPhone and Touch ID are trade marks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trade marks of Google Inc.

PayID is a registered trademark of NPP Australia Limited.

Consider if right for you. Eligibility criteria, terms and conditions apply. Fees and charges apply. See anz.com for more.

ReturnIf you think your card is lost or stolen, it's important that you let us know immediately.

ReturnApproval, eligibility criteria, T&Cs and Setup Fees apply.

ReturnAvailable on ANZ Online Saver and ANZ Progress Saver accounts.

ReturnCashrewards is offered by Cashrewards and not ANZ. Cashrewards is not exclusive to ANZ cardholders. The Cashrewards account is not an ANZ account. To earn cashback you must be a Cashrewards member. Exclusions and caps may apply. Eligibility criteria, cashback redemption and withdrawal conditions and T&Cs apply. Please visit Cashrewards for further details.

ReturnAvailable when the sending and receiving accounts are capable of processing faster payments. Not available on some ANZ accounts, including ANZ Home Loans and ANZ Personal Loans. Technical interruptions may occur.

Return