Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

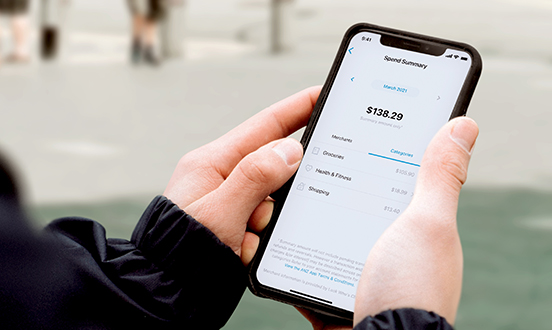

We’ll automatically sort your transactions by merchant or category in the ANZ App so that you can see valuable insights into your spending – like just how much you spend on coffee each month. Eep! No worries if the category doesn’t suit your transaction. You can quickly choose a more relevant one.

![]()

![]()

Our bank account comparison tool will show you some options side-by-side for term deposits, everyday transaction and savings accounts. Compare bank accounts

![]()

It takes less than 10 minutes to apply.

Other ways to apply: Visit any ANZ Branch or call 13 33 33 Mon to Fri, 8am to 8pm.

For joint account applications, after ANZ has opened your account, you will need to visit an ANZ branch with all account holders to sign a Joint Account Authority Form. You will not be able to access your joint account until this form is signed.

Any advice does not take into account your personal needs and financial circumstances and you should consider whether it is appropriate for you. ANZ recommends you read the ANZ Saving & Transaction Products Terms and Conditions (PDF) and the Financial Services Guide (PDF) which are available at anz.com or by calling 13 13 14 and the ANZ Plus and ANZ Save Accounts T&Cs available at anz.com.au/plus before deciding whether to acquire, or continue to hold, the product. Fees, charges and eligibility criteria apply.

Images and features shown are iOS versions. Feature availability and design may differ based on the device, operating system, or ANZ Plus app version.

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android, Google Play and the Google Play logo are trademarks of Google Inc.

BPAY® is registered to BPAY Pty Ltd ABN 69079137518.

PayID is a registered trademark of NPP Australia Limited.

™ ANZ Falcon is a trademark of Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Falcon is a trademark of Fair Isaac Corporation.

Eligibility criteria apply to the issue of ANZ Access Visa Debit card. Fees may apply (for example, overseas transaction fees, overseas ATM transaction fees and non-ANZ operator fees). Please refer to the ANZ Personal Banking Account Fees and Charges (PDF) and ANZ Saving & Transaction Products Terms and Conditions (PDF) for details.

ReturnMonthly account service fee waiver applicable to ANZ Access Advantage accounts if you deposit $2,000 or more by the last business day of the calendar month. You must satisfy the monthly deposit requirement to be eligible for the waiver in a particular month.

ReturnEligible accounts and payments only – sending and receiving account must be capable of processing faster payments. Technical interruptions may occur and some payments may be delayed e.g. for security screening.

ReturnA daily transaction limit of $1,000 applies to Pay Anyone transactions and $10,000 to BPAY® bill payments using the ANZ App. Higher payment limits may be available if you have registered for and use Voice ID and it is available on your device. Recipients require an account with an Australian financial institution to receive or collect Pay Anyone payments. Terms and conditions apply, view them at anz.com/app

ReturnMobile payments available on compatible devices and eligible ANZ cards.

Separate terms and conditions apply to the use of Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay.

Apple, Apple Pay and iPhone are trade marks of Apple Inc., registered in the U.S. and other countries.

Android, Google Pay, and the Google Logo are trademarks of Google LLC.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Fitbit and the Fitbit logo are trademarks or registered trademarks of Fitbit, Inc. in the U.S. and other countries.

Garmin, the Garmin logo, and the Garmin delta are trademarks of Garmin Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

ReturnIf you think your card is lost or stolen, it's important that you let us know immediately.

ReturnOn application for the waiver by an eligible customer, the monthly account service fee will be waived on one nominated ANZ Access Advantage account. For more information on Exemptions and Concessions please refer to ANZ Personal Banking Account Fees and Charges (PDF).

ReturnMobile payments available on compatible devices and eligible ANZ cards. View the full list at anz.com/mobilepayments. Terms and conditions apply to the use of Apple Pay (PDF), Google Pay (PDF), Samsung Pay (PDF), Fitbit Pay (PDF) and Garmin Pay (PDF).

ReturnCashrewards is offered by Cashrewards and not ANZ. Cashrewards is not exclusive to ANZ cardholders. The Cashrewards account is not an ANZ account. To earn cashback you must be a Cashrewards member. Exclusions and caps may apply. Eligibility criteria, cashback redemption and withdrawal conditions and T&Cs apply. Please visit Cashrewards for further details.

ReturnProvided you didn’t contribute to the loss, you let us know as soon as you found out about the loss and you have complied with the Electronic Banking Conditions of Use contained in your product terms and conditions.

ReturnRefer to ANZ Savings & Transaction Products Terms and Conditions (PDF) for criteria.

ReturnPlease refer to ANZ Personal Banking Account Fees and Charges (PDF) for fees and charges that apply.

ReturnDebit interest may apply. Please refer to ANZ Personal Banking Account Fees and Charges (PDF).

ReturnOpen your first ANZ Online Saver account and you'll receive an introductory fixed bonus rate of % p.a. for 3 months, on top of the ANZ Online Saver standard variable rate (currently ). After 3 months, the ANZ Online Saver standard variable rate, applicable at that time, will apply. The introductory fixed bonus rate is only available on the first ANZ Online Saver account opened by customers who have not held an ANZ Online Saver in the last 6 months. In case of joint account holders, the introductory fixed bonus rate offer will only be received if all customers are eligible.

ReturnANZ Online Saver is only available to customers who open or who are the account holders of, or signatories to, eligible ANZ everyday banking accounts with ANZ Internet Banking or ANZ Phone Banking access. Eligible accounts include ANZ Access Advantage, ANZ Access Basic, ANZ Pensioner Advantage, ANZ Progress Saver, ANZ V2 PLUS and ANZ Premium Cash Management Account. Terms and conditions and fees and charges apply to the eligible account.

ReturnLoans not eligible include ANZ Simplicity PLUS, ANZ Money Saver (no longer sold), ANZ Easy Start (no longer sold) and ANZ Interest-in-Advance Residential Investment Loans.

ReturnEligibility criteria apply to the issue of ANZ Access Visa Debit card.

Return