Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

Log in

Explore more

There's no room for guesswork when it comes to insuring your home and the belongings that make your house a home. The unexpected can happen, so it's good to be prepared. ANZ insurance can help you choose the right level of cover, so you can take comfort knowing your home and belongings are protected.

Home insurance helps cover the cost of repairing or rebuilding your home following an insured event. This includes natural disasters, such as a bushfire, flood, earthquake or storm, as well as theft and vandalism including accidental damage.disclaimer

Contents insurance helps cover the cost of replacing what's inside your home and property if it's damaged or stolen. You can take out just home insurance, just contents insurance or a combined home and contents policy.

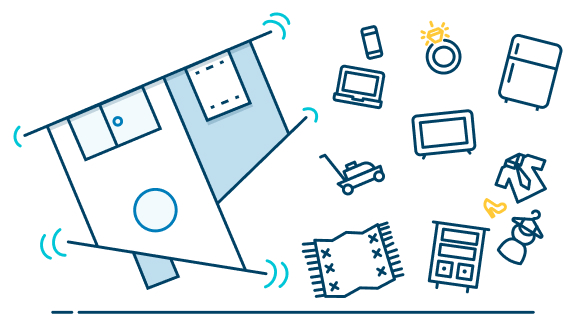

If you're unsure whether something falls under home or contents insurance, then imagine you tipped your home upside down. Generally, home insurance covers things that are fixed to your floors, walls and ceiling while contents insurance covers things that fall out.disclaimer

For homeowners the, benefits of ANZ Home Insurance include:

For homeowners and renters, the benefits of ANZ Home Insurance with Contents cover include:

For landlords, the benefits of ANZ Landlord Insurance include:

Making an insurance claim comes at an extremely stressful time. With 24/7 claims lodgement over the phone, help is with you when you need it most.

Read more about how to make your claim:

Need to make a claim now?

To make a claim, call 13 16 14. Make sure to have your policy number handy.

Want to learn more? The key facts sheets provide a great summary about what's covered, while the Product Disclosure Statements have more detail.

ANZ Home Building Key Facts Sheet – issued by CGU Insurance

ANZ Home Contents Key Facts Sheet – issued by CGU Insurance

ANZ Home Insurance Product Disclosure Statement – issued by CGU Insurance

ANZ Landlord Insurance Product Disclosure Statement – issued by CGU Insurance

ANZ Home Premium, Excess, Discount and Options Guide – issued by CGU Insurance

ANZ Landlord Premium, Excess, Discount and Options Guide – issued by CGU Insurance

ANZ Home Insurance Target Market Determination – issued by CGU Insurance

ANZ Landlord Insurance Target Market Determination – issued by CGU Insurance

The customer service team is your first point of contact for any enquiries, raising concerns or providing feedback.

We value your feedback regarding our performance and we’re committed to resolving any concerns you may have.

Our customer service team is your first point of contact for any enquiries, raising concerns or providing feedback. Our contact details are below. We will do our best to resolve your concerns genuinely, promptly, fairly and consistently, and keep you informed of the progress.

If you are not satisfied with the response to your complaint or feedback, your concerns will be escalated to our Complaints Resolution Centre.

Call us

Email us

Write to us

Customer Care

PO Box 213

Parramatta, NSW, 2124

If your concerns have not been resolved to your satisfaction, you can lodge a complaint with the Australian Financial Complaints Authority (AFCA) who provides fair and independent financial services complaint resolution that is free to consumers.

Time limits may apply to complain to AFCA and so you should act promptly or otherwise consult the AFCA website to find out if or when the time limit relevant to your circumstances expires. The AFCA contact details are:

Call

1800 931 678 on weekdays (except on public holidays) from 9am to 5pm (AEST)

Write to

Australian Financial Complaints Authority

GPO Box 3

Melbourne, Victoria, 3001

Visit online

This information was published on 3 July 2023 and is subject to change.

For new policies commencing from 3 July 2023 (inclusive) or policies migrated from QBE Insurance (Australia) Limited from 7 August 2023 (inclusive), ANZ Home Insurance is issued by Insurance Australia Limited (ABN 11 000 016 722, AFSL 227681) trading as CGU Insurance and distributed by ANZ under its own license. ANZ recommends that you read the ANZ Financial Services Guide (PDF), ANZ Home Building Key Facts Sheet (PDF), ANZ Home Contents Key Facts Sheet (PDF), ANZ Home Insurance Target Market Determination (PDF), ANZ Home Insurance Premium, Excess and Discounts Guide (PDF) and the ANZ Home Insurance Product Disclosure Statement (PDF) (available online or by calling 13 16 14), before deciding whether to acquire, or to continue to hold, this product.

For new policies commencing from 3 July 2023 (inclusive) or policies migrated from QBE Insurance (Australia) Limited from 7 August 2023 (inclusive), ANZ Landlord Insurance is issued by Insurance Australia Limited (ABN 11 000 016 722, AFSL 227681) trading as CGU Insurance and distributed by ANZ under its own license. ANZ recommends that you read the ANZ Financial Services Guide (PDF), ANZ Landlord Insurance Target Market Determination (PDF), ANZ Landlord Insurance Premium, Excess and Discounts Guide (PDF) and ANZ Landlord Insurance Product Disclosure Statement (PDF) (available online or by calling 13 16 14) before deciding whether to acquire, or to continue to hold, this product.

For new policies commencing from 3 July 2023 (inclusive) or policies migrated from QBE Insurance (Australia) Limited from 7 August 2023 (inclusive), ANZ Car Insurance is issued by Insurance Australia Limited (ABN 11 000 016 722, AFSL 227681) trading as CGU Insurance and distributed by ANZ under its own license. ANZ recommends that you read the ANZ Financial Services Guide (PDF), ANZ Car Insurance Target Market Determination (PDF), ANZ Car Insurance Premium, Excess and Discounts Guide (PDF) and ANZ Car Insurance Product Disclosure Statement (PDF) (available online or by calling 13 16 14) before deciding whether to acquire, or to continue to hold, this product.

For policies commenced before 3 July 2023 or policies renewed before 7 August 2023, ANZ Home Insurance is issued by QBE Insurance (Australia) Limited (ABN 78 003 191 035, AFSL 239 545). ANZ recommends that you read the ANZ Financial Services Guide (PDF), ANZ Home Building Key Facts Sheet (PDF), ANZ Home Contents Key Facts Sheet (PDF), ANZ Home Insurance Target Market Determination (PDF) and the ANZ Home Insurance Product Disclosure Statement (PDF) (available online or by calling 13 16 14), before deciding whether to acquire, or to continue to hold, this product.

For policies commenced before 3 July 2023 or policies renewed before 7 August 2023, ANZ Landlord Insurance is issued by QBE Insurance (Australia) Limited (ABN 78 003 191 035, AFSL 239 545). ANZ recommends that you read the ANZ Financial Services Guide (PDF), ANZ Landlord Insurance Target Market Determination (PDF) and ANZ Landlord Insurance Product Disclosure Statement (PDF) (available online or by calling 13 16 14) before deciding whether to acquire, or to continue to hold, this product.

For policies commenced before 3 July 2023 or policies renewed before 7 August 2023, ANZ Car Insurance is issued by QBE Insurance (Australia) Limited (ABN 78 003 191 035, AFSL 239 545). ANZ recommends that you read the ANZ Financial Services Guide (PDF), ANZ Car Insurance Target Market Determination (PDF) and ANZ Car Insurance Product Disclosure Statement (PDF) (available online or by calling 13 16 14) before deciding whether to acquire, or to continue to hold, this product.

Although Australia and New Zealand Banking Group Limited (ANZ) (ABN 11 005 357 522 AFSL 234527) distributes these products, ANZ does not guarantee or stand behind the issuers or their products.

This information is of a general nature and has been prepared without taking account of your personal objectives, financial situation or needs. Before acting on the information, you should consider whether the information is appropriate for you having regard to your objectives, financial situation and needs.

The ANZ App is provided by ANZ. Super and Insurance (if available) are not provided by ANZ but entities which are not banks. ANZ does not guarantee them. ANZ recommends that you read the ANZ App Terms and Conditions available at anz.com and consider if this service is appropriate to you prior to making a decision to acquire or use the ANZ App.

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

You need Adobe Reader to view PDF files. You can download Adobe Reader free of charge.

CGU do not cover loss or damage caused by a bushfire or grass fire, flood or named cyclone that occurs within 72 hours of the start of your policy. CGU won’t cover loss or damage as a result of an earthquake or tsunami if the loss or damage occurs later than 72 hours after the earthquake or tsunami occurring.

ReturnPlease refer to the PDS for a full definition of Building and Contents.

ReturnUp to an extra 25% on top of your building sum insured (known as Safety Net) if your home needs to be rebuilt or repaired as a result of an incident CGU has agreed to cover and the cost to repair or rebuild your home is higher than the building sum insured.

ReturnIf you're renting the home, CGU cover the reasonable extra rent costs for temporary accommodation. If you own and live in your home, CGU cover the reasonable costs of temporary accommodation. As long as you were living in the damaged home permanently before the incident, CGU cover up to 20% in addition to your building sum insured for up to 2 years for temporary accommodation for you and your pets, if your home suffers loss or damage and is unlivable from an insured event. You should seek CGU's agreement before incurring any out-of-pocket expenses to ensure you will be able to claim those costs back on your policy. If you do not obtain CGU's agreement first, CGU will only pay reasonable costs up to the amount CGU would have agreed to pay had you obtained CGU's prior agreement.

ReturnCGU doesn't cover actions of the sea: like sea actions caused by normal tidal movements like high tides and king tides. Refer to the ANZ Home Insurance Product Disclosure Statement – issued by CGU (PDF) for a full list of conditions, embargoes, limits and exclusions that apply.

ReturnCGU will pay up to:

$10,000 for any individual item of Portable Contents unless it is listed separately on Your Certificate of Insurance with a Sum Insured in which case CGU will pay up to the specified Sum Insured for this item if it is lost, stolen or damaged within Australia or New Zealand;

the Sum Insured for the group of ‘Portable Contents’, including any separately listed items, listed on Your Certificate of Insurance if they are lost, stolen or damaged within Australia or New Zealand; or

$10,000 in total for all items of Portable Contents if they are lost, stolen or damaged outside Australia or New Zealand.

If your building or contents are covered and your rental property is unliveable after a covered event, we pay up to 12 months of lost rent. CGU will cover either the weekly rent listed on your Certificate of Insurance, or the weekly rent in your rental agreement, whichever is less. A valid rental agreement is required.

ReturnCGU will deduct from your claim four times the weekly rent amount shown on your rental agreement, in addition to the standard excess. A valid rental agreement is required.

ReturnYou only have this optional benefit under your policy if you have specifically chosen and paid an additional premium for it and it is shown on your Certificate of Insurance as added to the policy.

Return