Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

4-minute read

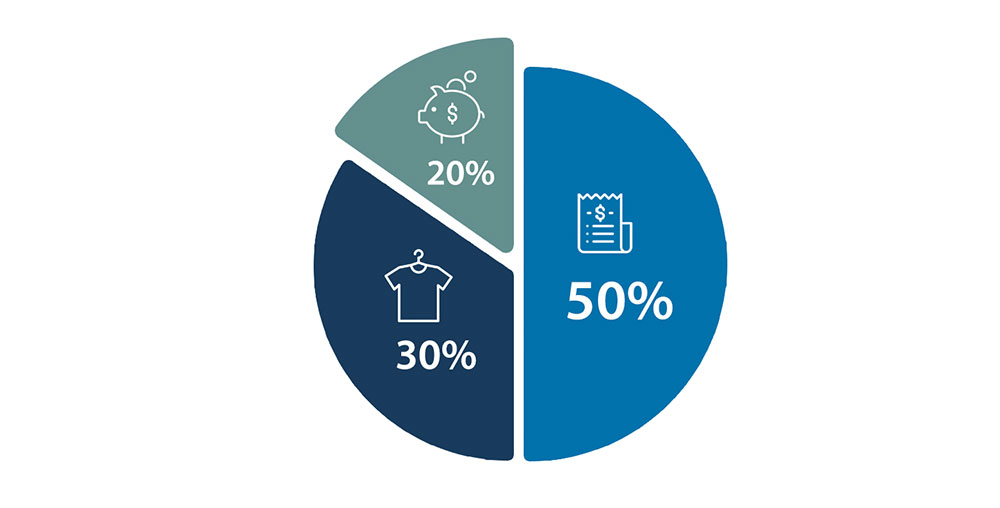

We know it can be hard to create a system for your money that's easy to follow and works hard for you. This is where the 50-30-20 budget can be a simple way to start.

The 50-30-20 budget (or rule as it’s sometimes referred) is a percentage-based budget concept that emerged in the late 90s.

This is a popular budgeting style due to its simplicity, flexibility and how it can apply to different stages of life. It’s based on percentages and not how much you earn, so you can adapt it to your own circumstances.

![]()

![]()

Needs are loosely defined as necessary costs for you to live, like a roof over your head, food in your mouth, electricity, hot water, transportation, credit card and loan repayments etc.

Possible account types:

![]()

Wants may include all those things that we enjoy but, let’s face it, could go without if we had to. Things like entertainment and social outings would fall into the wants category.

Possible account types:

![]()

Financial goals are completely dependent on what’s a priority for you and your life. You may be in a situation where debt reduction is your goal, saving for something special or for unexpected expenses.

Possible account types:

![]()

Let's imagine your fortnightly pay was $1,000. We'll use the example below to illustrate:

Half of it ($500) would stay in your designated account for all your needs, e.g. rent, bills, food and transport.

$300 could be set aside for your wants, e.g. nice clothes, a trip, social expenses, or that upcoming weekend away with your 'squad'.

The final $200 is set aside for savings and not touched. This could be used for financial buffers, saving for a home loan or other large goals.

![]()

The beauty of a percentage-based budget is that it’s customisable to your needs so you can adapt the percentages to what works for you (eg. 60-30-10, 55-30-15 etc). You get to set your own limits to live by.

There are options you can explore to try and reduce the cost of your needs. For example, shopping around for more competitive service deals on utilities, phone, internet could be a good place to start - see money saving tips for more info.

You may find that with your current circumstances there’s no room yet for saving or indulgences. Don’t be deterred, there are things you can do to start getting on top of your finances like, looking at ways to save on your needs, tracking your spending and starting a budget plan.

Introducing MoneyMinded. A self-paced, free, online resource to help people build their financial skills, knowledge and confidence. Whether you're looking to create a budget, reduce your debt or start saving, our program has something for you.

The information set out above is general in nature and has been prepared without taking into account your objectives, financial situation or needs. Before acting on the information, you should consider whether the information is appropriate for you having regard to your objectives, financial situation and needs. By providing this information ANZ does not intend to provide any financial advice or other advice or recommendations. You should seek independent financial, legal, tax and other relevant advice having regard to your particular circumstances.