-

Estimated reading time

5 minIn this article

- Learn how compound interest works

- How to make the most of it

- Superannuation and the benefits of compounding interest

- See some examples and scenarios

So quickly, compound interest is earning money on your money. And that money earning money on that money.

And that snowballing exponentially. It does the work for you, so you feel like it’s all going in the right direction without much effort.

It might not be widely understood, but it can be pretty powerful when it comes to planning for your future – especially if you start early!

So how does compound interest work?

With simple interest, you only earn interest on your initial savings deposit and it is not added to the closing balance of the account. But with compound interest accounts, it’s a snowball effect on your savings. You earn interest on your initial deposit PLUS any interest you’ve earned. Yes, that means you earn interest on your interest.

How can I make the most of it?

Make sure you choose a compound interest account that works for you. Explore different accounts and use the MoneySmart Compound Interest calculator to work out how much you’ll need to save each month in order to reach your long-term goals. The longer you save; the more interest you earn. So start as soon as you can and save regularly. You'll earn a lot more than if you try to catch up later.

Super Interesting

Did you know your super is an easy way to get money growing behind the scenes? It’s automatic once it’s set up and you earn compound interest on your contributions. But keep in mind its long term savings for retirement you can’t easily access.

Compound interest is a long game, but as you can see, one well worth playing.

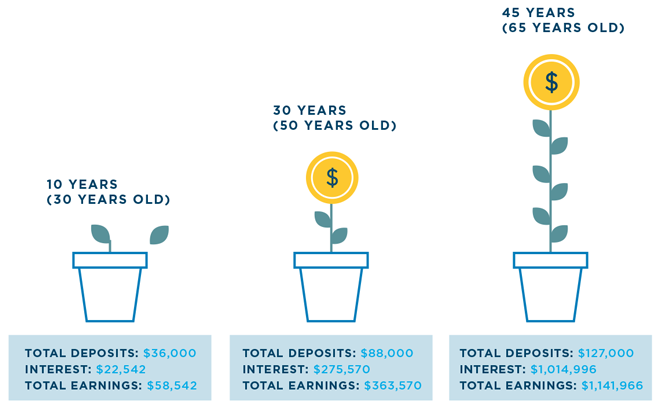

To explain compound interest further, we’ll use your superannuation account as an example.

Let’s say you have $10,000 in your super account to start with. The below shows what happens if you save $50 a week from the age of 20 based on an average 7.23% super return*.

You can forecast what you could personally achieve using MoneySmart’s compound interest calculator.

*The returns estimated here do not include fees and charges.

The earlier you start saving, the better

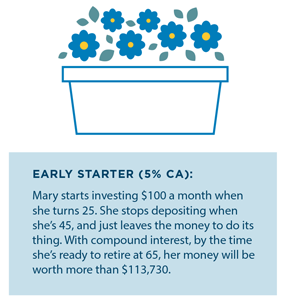

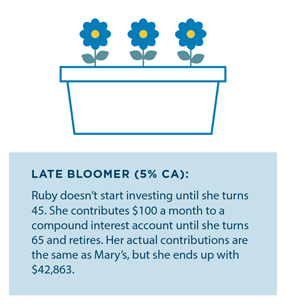

With compounding on your side, every dollar you invest will add exponential value over time, every year increasing your interest even if you stop investing. For example:

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.