Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

Who doesn’t love a shortcut to becoming a Financial Wellbeing? Start off with the handy 50/30/20 tool then sort your expenses and create a quick budget. It’s the blueprint for I-got-this-success. Ready?

Popular theory has it that the best budgets abide by the 50/30/20 rule: 50% goes to your needs, 30% to your wants and 20% your goals. This easy calculator will help you figure out how much money you have available for each category – just fill in your monthly income. Remember, everyone’s buckets will look a little bit different.

This calculator illustrates a 50/30/20 split but consider what will work for you. You may want to put less to your wants and more to your savings goals - you're the budget boss!

These are the important things you can’t ignore. Your home, three meals a day, running water, electricity, loan repayments. If it can’t be skipped, it goes in this bucket.

New clothes. Weekly brunch. Concert tickets. Your wants are the things that make life good, but you could potentially give up if you absolutely had to. If you can afford it, set aside 30% of your income for the fun stuff.

This bucket looks different for everybody. You might be saving for a house, paying off debt or building up some emergency savings. Whatever your goals are, try to give them 20% of your income.

![]()

Money comes in and money goes out. But where is it actually going? See how your spending stacks up by dividing your current expenses into needs or wants based on what’s important to you.

Need a helping hand? This free expense tracking calculator (PDF 963kB) is a good place to start. See how much you’re spending and decide if it’s time to cut your losses.

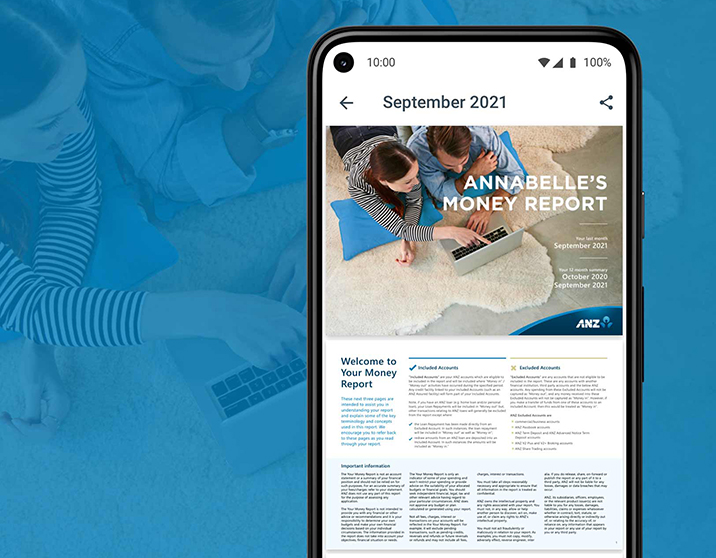

Already an ANZ customer? View your personalised Your Money Report in the ANZ App, so you can get a snapshot of where some of your money is going, by merchant and category, every month.

We’re all about budgeting smarter, not harder. So, if something is a priority for you, make it work - but play it smart. Wait for cheap ticket nights. Join rewards programs. Flick through mail for bargains. Where there’s a want there’s a way, so note down what you want to prioritise.

![]()

Not all of us get excited by a well-constructed Excel spreadsheet, which is why we’ve made it easy to manage your money with this free 50/30/20 budget worksheet (PDF 753kB). Simply add in your income, your expenses and other important monthly costs, and voila. You’ve got a better understanding of your finances and can start prepping for the future. Or, if you prefer to build your budget online, check out our budget building tool.

Keeping your budget close will help you see your costs more clearly. Download or print your budget so you can refer to it as you work through the rest of the program.

Pro tip

Things change and your budget should too. Remember to come back and update your budget if your income or goals change.

Living by your budget is all about keeping track of where your money is going – from daily spending and savings deposits to emergency expenses. You can keep track of this with an expense tracker on your phone, a big old Excel spreadsheet, or go old school with pen and paper. The important thing is that you start paying attention to it.

![]()

If you’re an ANZ customer, you can use the ANZ App to see valuable insights into your spending – like how much you spend by category and merchant each month. Plus, Your Money Report gives you a snapshot of some of your money in and money out across your eligible ANZ accounts, and is packed with graphs and insights to help you to get to know your money better.

Get Your Money Report in the ANZ App

The information set out above is general in nature and has been prepared without taking into account your objectives, financial situation or needs. By providing this information ANZ does not intend to provide any financial advice or other advice or recommendations. You should seek independent financial, legal, tax and other relevant advice having regard to your particular circumstances.

The Bucket your Money tool is provided for illustrative purposes only and is based on the accuracy of information provided.

ANZ does not store the information provided in the Bucket your Money tool or use the information you provide for the purpose of assessing any application.

ANZ does not use the information you provide for the purpose of assessing any application.

The ANZ App is provided by Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Super, Shares and Insurance (if available) are not provided by ANZ but entities which are not banks. ANZ does not guarantee them. This information is general in nature only and does not take into account your personal objectives, financial situation or needs. ANZ recommends that you read the ANZ App Terms and Conditions available here for iOS and here for Android and consider if this service is appropriate to you prior to making a decision to acquire or use the ANZ App.

ANZ App for Android is only available on Google Play™. ANZ App for iPhone is only available from the App Store.

Apple, Apple Pay, Apple Watch, Face ID, iPad, iPhone and Touch ID are trade marks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trade marks