-

Estimated reading time

8 minIn this article

- The pros and cons of investing in super or shares

- What to consider before deciding which one is right for you

- How to get started with our 4 C's approach

So, you’ve managed to save up some extra cash and you’re starting to think about investing it. There are a range of investment options out there.

Some people top-up their super, others build their own share portfolio. Both have pros and cons depending on your needs, and this guide will take you through the details. Always remember to research your options thoroughly, and to seek independent financial and tax advice.

Is investing in super a smart idea?

Super is a way of saving for retirement. Your employer is required to pay 11% of your salary into your super fund and this money is invested by your super provider into various assets such as property, bonds, cash and shares. The growth is then reinvested to help the balance grow. Think of it as your own personal investment manager.

With super you also have the option to make voluntary contributions, and this is a great way to put your savings into an investment. Annually you can put up to $27,500 of your income into super as salary sacrifice and the money will be taxed at the 15% concessional tax rate instead of your standard income tax rate (note that high income earners may pay an additional 15% tax). For example, if you earn between $45,001 and $120,000, the current tax rate (2023/2024) is 32.5%, so you could make quite a sizeable tax saving. Any contributions over this amount will be taxed at your marginal tax rate and an excess concessional contributions charge will apply.

It’s not a one-size-fits all solution and there are many factors, that can impact the performance of your superannuation. So always seek financial and tax advice and work out if this is right for you!

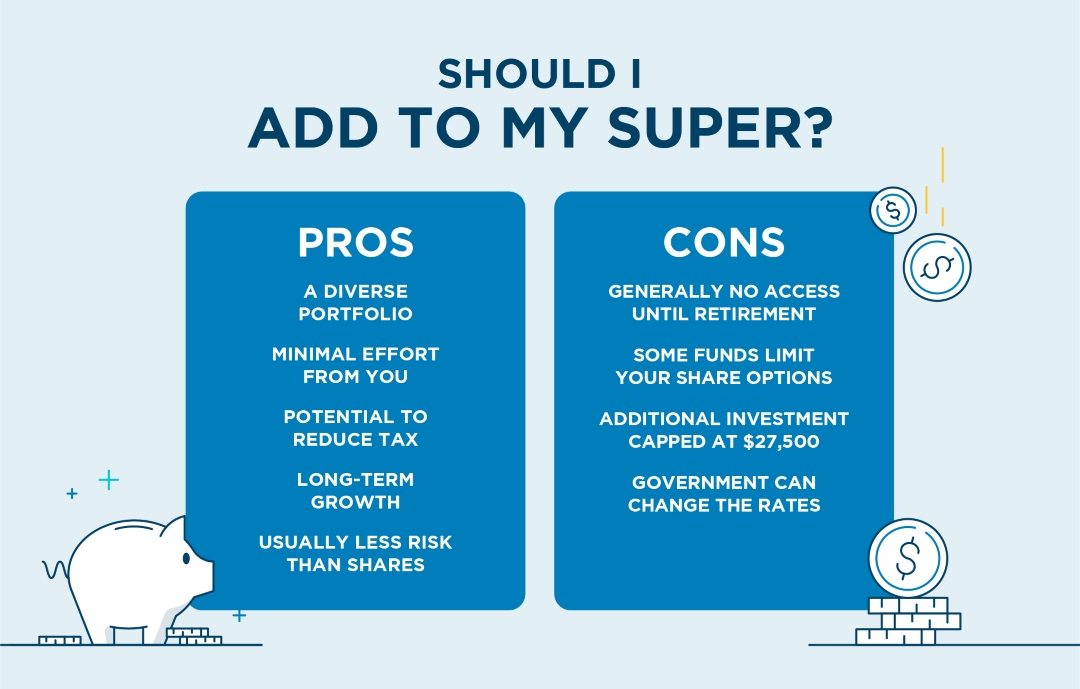

Pros and Cons of Investing in Super

Pros

- Super is invested in a diversified portfolio – less risk than shares alone

- Your super is managed with minimal or no effort from you

- You can reduce your taxable income through salary sacrificing

- Benefit from long-term growth

Cons

- Funds are generally locked in until you retire

- Certain types of funds don’t allow you to pick the shares you invest in

- The amount you can invest each year is limited to $27,500 before higher tax rates kick in

- Super is regulated by Government and policies can change over time

Could investing in super be for you?

If you’re looking at a long-term investment and want to build growth over time, as well as reducing your taxable income, then investing in super could be a good option for you.

Is investing in shares a smart idea?

When you buy shares, you’re effectively buying a small stake in a company. Companies sell shares to raise money, which they then use to expand their business. When you invest in shares, you’re free to buy and sell some or all of them at any time. If the company performs well, demand for its shares will generally increase, pushing its share price up.

This is good news for you as it means you can sell your shares for a higher price than you purchased them for. But while the money you invest has the potential to grow, it could also fall in value so you may get back less than you invest.

You could also receive a share in the company’s profits. Called 'dividends', these payments are a portion of company profits paid out to shareholders. Companies aren’t required to pay dividends, but many do.

Pros and Cons of Investing in Shares

Pros

- You can sell or buy at any time

- Choice over what you invest in

- No limit on the amount you can invest

- You could get dividend payments

Cons

- High risk – you could lose money

- Requires management and in-depth research

- Less diversified portfolio than super

- You have to pay tax on any money gained

- More expensive as you need to pay brokerage fees

Is it risky to invest in shares?

Like any investment, there are some risks associated with investing in shares - which is why it pays to do your research. Firstly, share prices can go up and down daily. And depending on where and what you invest in, there are a number of outside factors that impact this price. You also need to understand the market and the industries in which you plan to invest to determine if they’re likely to perform well or not. Finally, knowing why you’re investing can help you decide whether your investment is higher risk for you. For example, if you’re investing with the aim of making some quick cash, you might be putting yourself at risk – because shares generally are a longer-term investment. So have a think about your goals and objectives before investing.

Could investing in shares be for you?

If you’re trying to save enough money to cover the cost of perhaps a new car, holiday or wedding in the short term, then investing in shares is probably not the right option. But if you’re putting money away for something at least 5 years away – such as a having a child, private school fees, or just more flexibility in the medium term – then investing may be right for you.

Do your research! Carefully consider the risks and benefits as well as any fees, charges, terms and conditions.

How do I get started?

Whether you’re looking to invest in super or shares, there are a few things you can do now to get started.

If you’re interested in boosting your super, following our four C’s can help get your started:

- Connect – log in or call your super fund so you know how your super is performing.

- Consolidate – if you’ve changed jobs, you may have more than one superannuation account. Contact the Australian Taxation Office (ATO) and get them to send you a list of all your superannuation accounts, then consider consolidating so all your money is in one place.

- Contribute – consider contributing extra money to your super. The more you deposit into your super, the more it will grow.

- Consider – look at different superannuation providers and consider which one has the best plan for you and your future.

If shares sound like something you want to learn more of, check out these resources to get started:

- ANZ LifeGuide: Investing in Your Future

- ANZ YouTube: Superannuation Explained

- MoneySmart: How to invest in shares

Whether you decide to invest in super or shares, or even a combination of both, the sooner you start, the greater your potential for larger returns, as your money has longer to grow.

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.