-

Estimated reading time

7 minIn this article

- Some scenarios on how long it could take to save $10k

- Learn what SMART finance goals are

- How to choose the right kind of savings account

Rainy days can’t always be predicted. But smart savings goals are like an umbrella that can’t flip inside out, sheltering you from unexpected financial squalls until sunny days appear again.

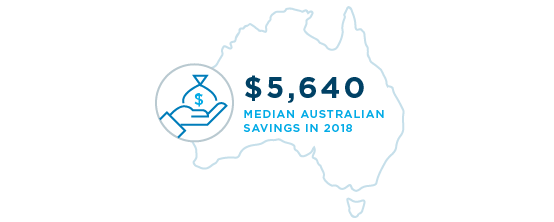

Researchdisclaimer shows that having even $1,000 as a buffer can make a huge difference to your financial wellbeing. But the ANZ Financial Wellbeing survey found that approximately 22% of Australians have no savings. Zero.

Ready to take your savings into overdrive? Start with these quick tips to reach your savings goal – whether that’s $1000 or the big $10k.

What are SMART finance goals?

We often hear people ask, “How much do I need to put into savings?” The truth is, that depends on how much you can realistically manage. It’s great to aim high but your saving plan will be much more achievable if your goals are SMART: Specific, Measurable, Achievable, Realistic and Timely:

Specific: Spell it out, write it down.

Measurable: Keep your eye on the target.

Achievable: Don’t try change the world, just challenge yourself.

Realistic: Is it realistic based on your current situation?

Timely: Set a deadline.

Knowing how much you’ve got coming in, and where you're currently spending your money (including servicing any debts) can help you come to a realistic figure. Then, follow these tips:

Hot tip: Set it aside

Once you’ve got an idea of how much you want to save each month, you could put it away the day your salary lands in your account. Don’t wait, just remove it and forget it. Like it was never there. You could set up automatic transfers so you don’t even need to remember to do it, and anything left over at the end of the month can be put away too. Just remember to do what's right for you.

Choose the right kind of savings account

The kind of savings account you have can make a real difference to your long-term goals. An account with a high compound interest rate might be right for you. Alternatively, term deposits are locked accounts that you can’t withdraw from for a set period of time, making them great interest earners in the long-term.

Be sure to check for:

- Minimum monthly deposits that need to be met

- Monthly or annual account fees

- Offers of bonus interest if you don’t make any withdrawals

Don’t forget to treat yo’self

There’s nothing like the promise of a new gadget or a culinary splurge to help motivate your daily decisions. Saying no to superfluous wants can feel like a restriction, but not if you’ve put money aside for the good things in life - just don’t go over the amount you’ve allocated. You deserve it.

Do your best

Not everyone can save $10,000 but working towards a cushion of $1,000 in the bank will give you a solid base. You never know, you might find your saving rhythm sooner than expected and be on your way to $10k before you know it. Do your best, and if you need more help, know that you have tools and resources available.

Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.