Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

We've updated our statements to help you quickly find the information you need

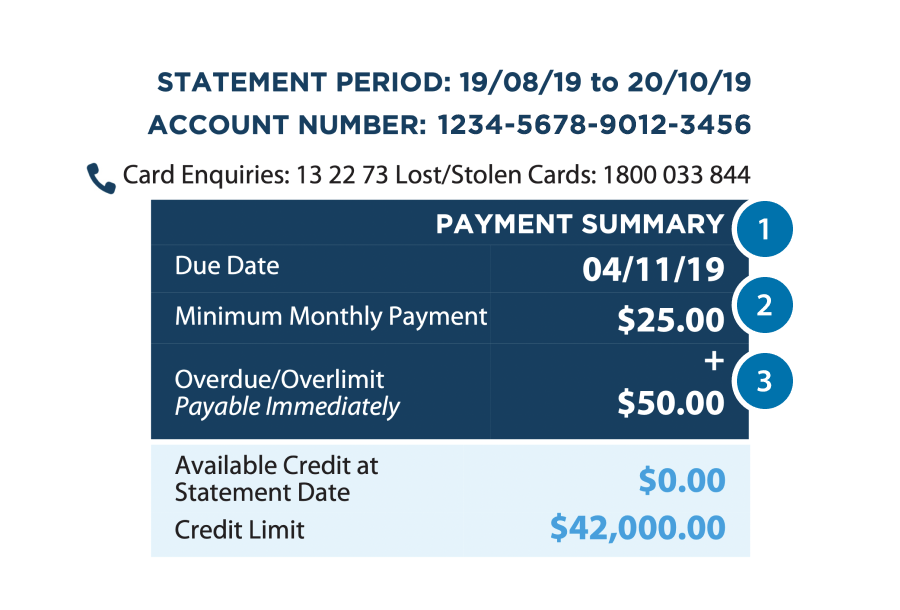

This area highlights the Due Date, when your Minimum Monthly Payment should be received by ANZ. You might need to make the payment before this date to allow enough time for it to reach us. Of course, you can also make additional payments at any time.

This is the minimum amount you must pay by the Due Date shown on the statement. If you only pay the minimum, you’ll end up paying more interest and it may take longer to pay off or reduce your credit card balance.

Any Overlimit or Overdue balance is separate from the Minimum Monthly Payment and needs to be paid immediately. You should ensure that you make payments on time to help avoid any late fees that might apply. The Minimum Monthly Payment is also required by the due date.

![]()

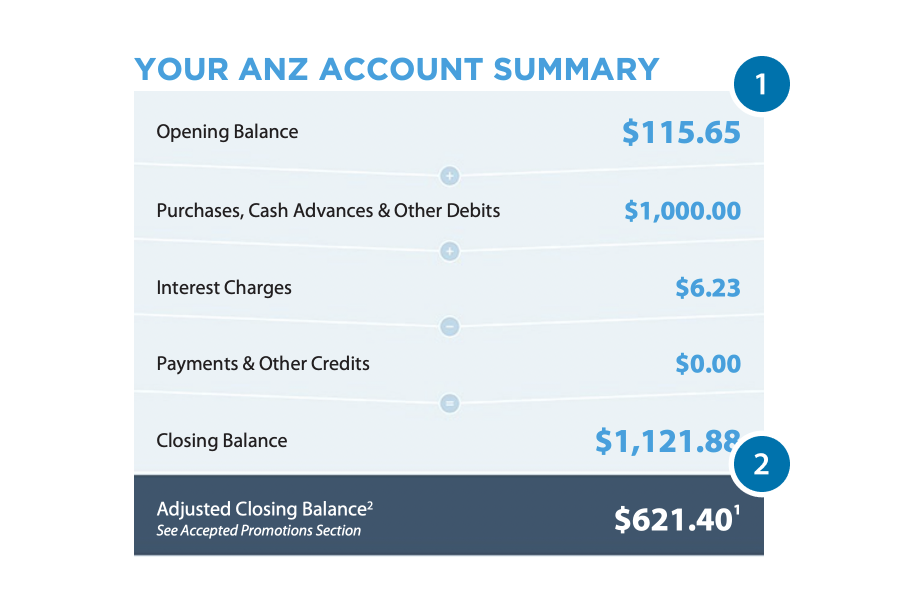

This is an overview of your account from the opening balance, through all of the transactions for the period, to the Closing Balance. For specific transaction details you can refer to the second page of your statement.

This is your outstanding balance at the beginning of the Statement Period shown on your statement.

The Adjusted Closing Balance is the Closing Balance less the sum of any Instalment Plan, Buy Now Pay Later Plan and the Promotional Balance Transfer Plan balances plus any Instalments due.

![]()

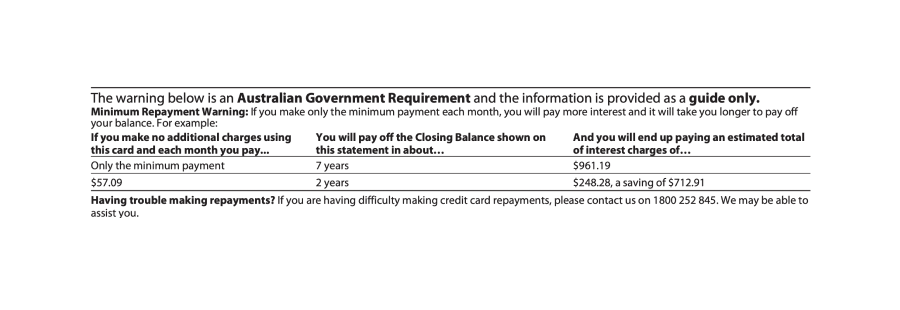

If you only make the minimum payment each month, you will pay more interest and it will take you longer to pay off your balance. The information in the warning is there to help you see how paying more than the Minimum Monthly Payment each month could help you pay off the Closing Balance more quickly.

You can make your own calculations using the MoneySmart credit card calculator to suit your own specific needs.

Also, you could use the information in the warning as a guide to:

Make sure to check your statement if you make further transactions, as this may increase your Minimum Monthly Payment if the transactions you make in a given month increase your Closing Balance.

![]()

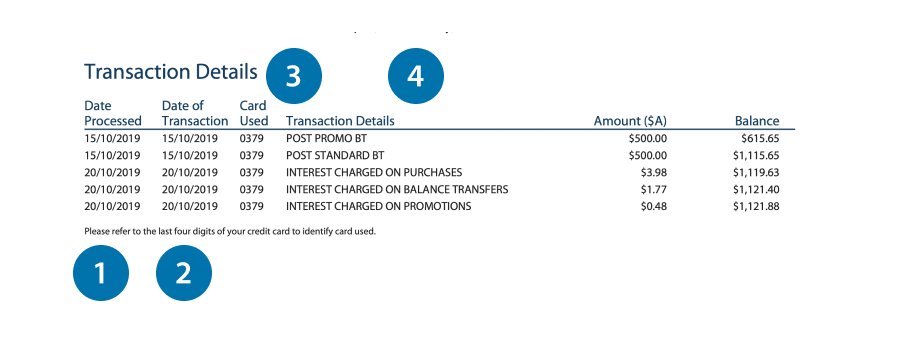

The date the transaction was processed to your account. This may be different to the date of the transaction due to merchant processing delays, weekends or public holidays.

The date when the transaction was made, which should match your receipt.

This helps you identify which card was used for a transaction. If you have additional cardholders each card number will be itemised separately. To check which card was used, match the card used to the last 4 digits on the plastic card.

Explains the transaction. It could be the shop, business or company name of the Merchant/Retailer, whether it was a payment, cash advance or fees and charges for the statement period. Please note that some businesses might have a different trading name to the billing name that appears on your statement

When you need to look closer at each transaction, you'll find all the information for this account statement period from the second page of the statement. If you see a transaction that you don't believe is accurate, you can find out more about how to dispute a transactiondisclaimer.

![]()

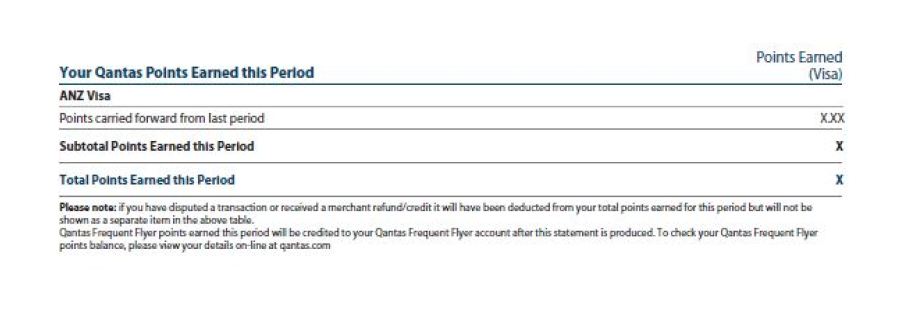

If you have an ANZ Frequent Flyer credit card you’ll be able to see how many Frequent Flyer Points you’ve earned during this Statement Period.

If you have an ANZ Rewards credit card, you can view your points balance online at anzrewards.com, and log in to your account.

![]()

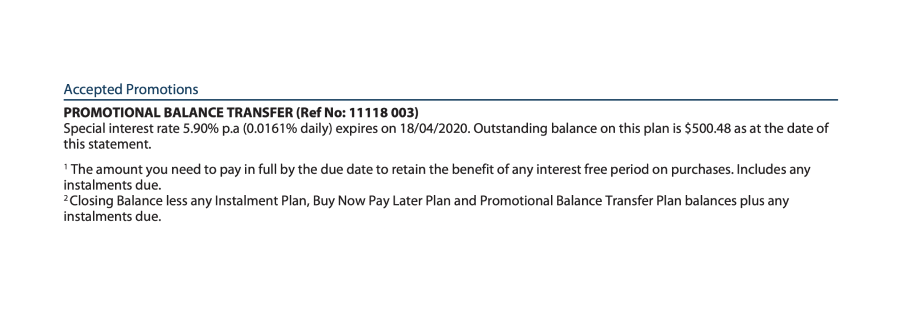

If you have any promotions and offers that you've accepted into your credit card account, they will show in the 'Accepted promotions' section on your statement. These can include Balance Transfers as well as any active ANZ Instalment Plans.

If you have an ANZ Instalment Plan on your account and you’re currently eligible for Interest Free Days on your purchases balance, you need to make sure you pay at least the ‘Adjusted Closing Balance’ on your statement, by the Due Date. That way, you can keep enjoying your Interest Free Days. Something to note, if you pay the ‘Closing Balance’ in full, you will also pay out your Instalment Plan in full.

You only have one Account Number, but you may have multiple card numbers on the one account. Even if you have a few different card numbers (such as different numbers for additional cardholders), you’ll be able to see transaction details for all the cards on your account statement.

This is the period to which your statement of account relates. The actual number of days in a Statement Period varies, depending on the length of the month, when your account was opened and when business days occur.

This amount is the remaining amount you can spend on your credit card account as at the end of the Statement Date shown on your statement. This amount may not include transactions that are in the process of being posted to your credit card account.

You can check your available credit limit online with ANZ Internet Banking or the ANZ App.

This is the outstanding balance on the credit card account as at the end of the Statement Period, including outstanding Instalment Plan and Buy Now Pay Later Plan balances (if any).

If your credit card account has interest free periods on purchases, you can avoid paying interest on the purchases balance by always paying the full Closing Balance (or if applicable, the 'Adjusted Closing Balance') shown on each statement of account by the applicable Due Date.

This is the amount of interest charged to your credit card in Statement Period shown on your statement.

View the current rates for our ANZ credit cards. You can use your credit card account for purchase, cash advances and balance transfers. These transactions may attract different interest rates.

Please refer to the ANZ Credit Cards Conditions of Use (PDF) for a definition of each of these different transaction types.

If your credit card account has an interest free period on purchases, you can avoid paying interest on the purchases balance by paying the full Closing Balance (or if applicable, your 'Adjusted Closing Balance') by the Due Date shown on your statement.

If you have an ANZ Instalment Plan on your credit card account and you are currently eligible for Interest Free Days on your credit card purchases, make sure you pay at least the ‘Adjusted Closing Balance’. That way you can keep enjoying your Interest Free Days. It’s important to note, Interest Free Days do not apply to Amounts on an Instalment Plan (unless the Instalment Plan is a no interest Plan).

Whether you prefer to make manual or automatic payments each month on your ANZ credit card, chances are we have an option that’ll suit your budgeting style. With banking tools like ANZ Internet Banking and the ANZ App you can perform manual payments or manage automatic payments online, anytime. See how easy it can be.

The information in this statement is given for illustrative purposes only and may not reflect how charges are calculated under your credit card contract.

BPAY® is registered to BPAY Pty Ltd ABN 69079137518.

Apple, the Apple logo, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Android, Google Play and the Google Play logo are trademarks of Google Inc.

Time limits apply, so it’s important you contact us as soon as you can.

Return