Fraud protection.

Now it's personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Issac Corporation.

![]()

ANZ is committed to helping our customers reach their financial goals. Below are just some of the tools and guides to assist you.

Looking for a bank account? Start here

Buy, reno or refi your home with our help & guides

See the latest credit card offers

Learn about the latest scams and fraud

Boost your financial wellbeing

Need some help? Visit our Support Hub

![]()

![]()

Soften the impact of the cost of living with saving strategies and budgeting tips to keep on top of your finances. The Financial Wellbeing Hub offers actionable info to manage the cost of living crisis and help you get in control and feel more confident in tomorrow.

Cost of living: 13 practical tips for you

3 tips for budgeting in a financial crisis

Discover unclaimed money and benefits

Get your financial wellbeing score and tips to track expenses

![]()

![]()

![]()

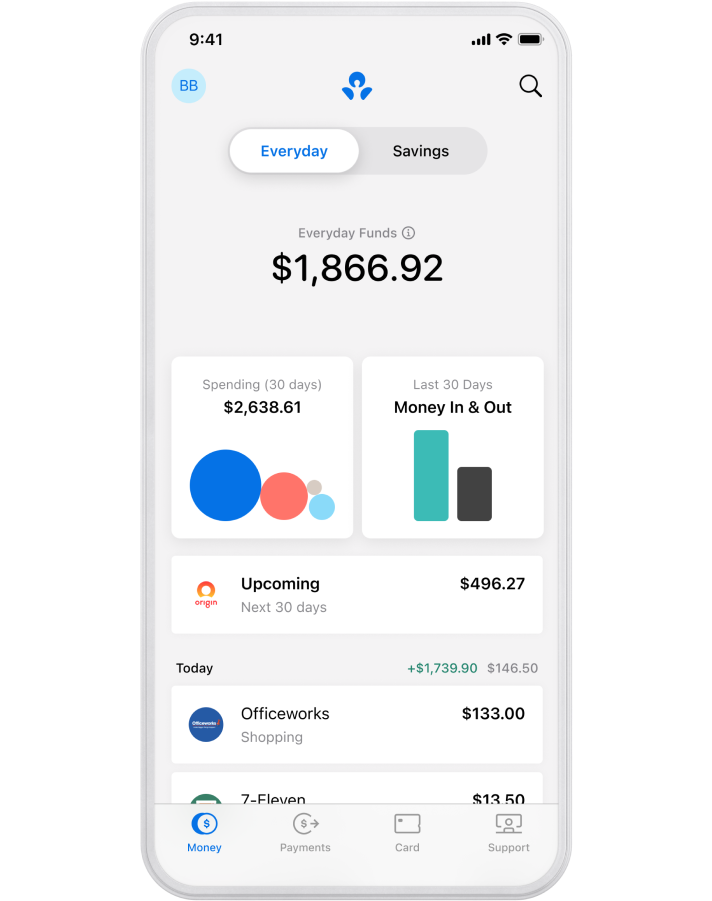

The ANZ Plus app is packed with smart money management tools designed to help you spend less and save more. Use the ANZ Plus app to:

You’ll get started with ANZ Plus Everyday and ANZ Plus Growth Saver accounts. To access other ANZ accounts, you can use the ANZ App.

![]()

![]()

Need a hand with online banking, PayID®disclaimer or digital wallets? Or help with a product or service of ours? If it’s support you’re after, you'll find it here.

Pay on the go with your phone or wearable

International payments and overseas travel

Compare our latest interest rates and fees

Accessibility and inclusivity for our customers

What is Confirmation of Payee (CoP)?

Advice does not take into account your personal needs, financial circumstances or objectives. Please consider if it is appropriate for you and read the terms and conditions, Product Disclosure Statement and Financial Services Guide before acquiring any product. See ANZ Plus Deposit Account T&Cs for ANZ Plus Everyday and ANZ Plus Growth Saver accounts. Applications for credit subject to approval. Terms and conditions available on application. Fees and charges apply.

The ANZ App is provided by Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Super and Insurance (if available) are not provided by ANZ but entities which are not banks. ANZ does not guarantee them. This information is general in nature only and does not take into account your personal objectives, financial situation or needs. ANZ recommends that you read the ANZ App Terms and Conditions available here for iOS (PDF) and here for Android (PDF) and consider if this service is appropriate to you prior to making a decision to acquire or use the ANZ App.

Images and features shown are iOS versions. Feature availability and design may differ based on the device, operating system, or ANZ Plus app version.

Falcon® is a registered trademark of Fair Isaac Corporation.

Different interest rates apply to different investment amounts, terms and interest frequencies. Rates are subject to change. Early withdrawal fees will apply and the account will incur an interest reduction in respect of the money withdrawn or transferred early. Refer to ANZ Saving and Transaction Terms and Conditions (PDF). At maturity we will reinvest your ANZ Advance Notice Term Deposit based on the reinvestment consent you have given us and in accordance with instructions you have provided. If you choose to reinvest your principal (and interest) at the end of the investment term, the interest rate applicable to your ANZ Advance Notice Term Deposit may be lower than the interest rate on your maturing ANZ Advance Notice Term Deposit. If your circumstances change or this product is no longer suitable for you, please contact ANZ at or prior to maturity, or within your 7 day grace period (following reinvestment) to make alternative arrangements.

ReturnCashback offer available to customers who apply for (1) a new ANZ Personal Loan of $15,000 or more or (2) an ANZ Personal Loan increase with a total loan amount of $15,000 or more. This offer may be withdrawn or changed at any time without notice. Without limiting any other provision of these terms and conditions, this offer is not available in connection with, or in addition to, any other ANZ Personal Loan offer, promotion, rebate or benefit. The loan must be approved, and the funds drawn down to be eligible for the cashback offer. There is a limit of one cashback offer per eligible customer within an 18-month period. The cashback payment will be paid within 120 days of drawdown into the transaction account which the loan funds are disbursed into. For joint applications, only one cashback payment will be paid in total for the application and will be paid to the first listed applicant. For joint applications, the account for funds disbursements must include the name of the first listed applicant. Applications for a joint ANZ Personal Loan or an increase of a joint ANZ Personal Loan may only be made in branch. If a customer closes their ANZ Personal Loan account or transaction account before the cashback payment is paid, they will become ineligible for this offer. Applications for credit are subject to ANZ’s eligibility and credit assessment criteria. If you have any questions about the tax treatment of the cashback offer, please discuss with a tax agent or the Australian Tax Office.

ReturnPayID is a registered trademark of NPP Australia Limited.

ReturnA minimum deposit of $5,000 is required to open an ANZ Advance Notice Term Deposit or an ANZ Term Deposit. This calculator has been set to a maximum deposit of $4,999,999. If you want to invest $2,000,000 or more, please call 1800 008 177 or visit your nearest ANZ Branch to discuss your term and interest rate.

ReturnEarly withdrawal fees will apply. An administration fee of $30 will be charged and the account will incur an interest reduction in respect of the money withdrawn or transferred early. An ANZ Advance Notice Term Deposit has a 31 day notice period. This means that if you request an early withdrawal or transfer of all or part of your funds, the funds will not be provided until the 31st day after the request (or, where that is a non-business day, on or before the next business day). Refer to the ANZ Saving and Transaction Products Terms and Conditions (PDF 746kB) for further details.

ReturnInterest rates current as at and subject to change at any time. Different interest rates apply to each term deposit product and to different investment amounts, term lengths and interest frequencies. Early withdrawal fees may apply. Certain rates do not qualify for additional bonus interest rates and are not available in conjunction with any other bonus or special interest rate offer. For Advance Notice Term Deposits, this applies to investment terms of 3, 4, 6, 9, 11 and 12 months, as well as all term lengths of greater than 12 months. For Term Deposits, this applies to investment terms of 3, 6, 9 and 12 months as well as all term lengths of greater than 12 months.

ReturnThe principal difference between an ANZ Advance Notice Term Deposit and an ANZ Term Deposit (apart from the interest rate that applies) is that you must provide 31 days’ notice to ANZ if you wish to make an early withdrawal or transfer of all or part of your funds from an ANZ Advance Notice Term Deposit account. Further details are set out in ANZ Saving and Transaction Products Terms and Conditions (PDF 746kB).

ReturnTransaction fees may apply, see the ANZ Plus Deposit Account T&Cs for details on these fees. A $10 monthly fee applies if you link your ANZ Plus Everyday account to your ANZ Plus Home Loan as an offset account.

ReturnThe upcoming expenses tool is a general guide only and is based on historical debits to the ANZ Plus Everyday and ANZ Plus Flex Saver accounts. Images and features shown are iOS versions. Feature availability and design may differ based on the device, operating system, or ANZ Plus app version.

ReturnYou must be an existing ANZ Plus customer to open a Joint ANZ Plus deposit account.

ReturnWe use the effective daily balance of your ANZ Plus Growth Saver account at 11:59pm (AEST/AEDT) on the last business day of the month to determine if you've met the requirement to grow your balance. See the ‘Earning interest’ section of the ANZ Plus Deposit Account T&Cs for more about what’s included in your balance, how interest is calculated and how we work out if you're eligible for bonus interest. See anz.com.au/plus/interest-fees for interest rates. Interest rates are variable and subject to change.

If you're new to ANZ Plus, ANZ Plus Growth Saver is only available if linked to an ANZ Plus Everyday account. Any advice is general and might not be right for you. The Financial Services Guide, Target Market Determinations and ANZ Plus Deposit Account T&Cs are available for your reference. You should read them before deciding to apply for or keep these products.

ReturnDifferent interest rates apply to different parts of the effective daily balance of your ANZ Plus Flex Saver account. A higher rate applies for that part of the effective daily balance that is up to $5,000, and a lower rate applies to that part of your effective daily balance that is above $5,000. Interest rates are variable and subject to change. See the ‘Earning Interest’ section of the ANZ Plus Deposit Account T&Cs for more information about how interest is calculated. See anz.com.au/plus/interest-fees for interest rates. To be eligible for the ANZ Plus Flex Saver account you must be an existing ANZ Plus customer.

ReturnMonthly account service fee waiver applicable to ANZ Access Advantage accounts if you deposit $2,000 or more by the last business day of the calendar month. You must satisfy the monthly deposit requirement to be eligible for the waiver in a particular month.

ReturnOn application for the waiver by an eligible customer, the monthly account service fee will be waived on one nominated ANZ Access Advantage account. For more information on Exemptions and Concessions please refer to ANZ Personal Banking Account Fees and Charges (PDF).

ReturnTerms and conditions apply. No transaction fee access relates to the following: a successful cash withdrawal and an account balance query. Daily withdrawal limits may apply. For certain ANZ cards, withdrawals from an ATM may attract interest, and you may also have to pay a cash advance fee. For details on cash advance fees, transactions that are considered to be a ‘cash advance’ and other charges, please refer to your applicable product terms and conditions. Eligibility criteria, account fees and interest, charges may apply. Visit anz.com for more information.

ReturnAvailable when the sending and receiving accounts are capable of processing faster payments. Not available on some ANZ accounts, including ANZ Home Loans and ANZ Personal Loans. Technical interruptions may occur.

ReturnA daily limit of $1,000 applies for Pay Anyone payments in the ANZ App. Higher payment limits may be available if you have registered for and use Voice ID and it is available on your device. A daily Pay Anyone limit of between $1,000 to $10,000 applies in Internet Banking. A higher limit may be available with ANZ Shield. Recipients require an account with an Australian financial institution to receive or collect Pay Anyone payments. Terms and conditions apply, view them at anz.com/app.

ReturnMobile payments available on compatible devices and eligible ANZ cards.

Separate terms and conditions apply to the use of Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay.

Apple, Apple Pay and iPhone are trade marks of Apple Inc., registered in the U.S. and other countries.

Android, Google Pay, and the Google Logo are trademarks of Google LLC.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Fitbit and the Fitbit logo are trademarks or registered trademarks of Fitbit, Inc. in the U.S. and other countries.

Garmin, the Garmin logo, and the Garmin delta are trademarks of Garmin Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

ReturnProvided the cardholder didn’t contribute to the loss and notified ANZ promptly of the fraud.

ReturnDeposits are protected up to a limit of $250,000 for each account holder under the FCS scheme.

ReturnProvided you didn’t contribute to the loss, you let us know as soon as you found out about the loss and you have complied with the applicable product terms and conditions, and any applicable Electronic Banking Conditions of Use contained in your product terms and conditions.

ReturnOther ownership structures may be available.

ReturnDebit interest may apply. Please refer to ANZ Personal Banking Account Fees and Charges (PDF).

ReturnPlease refer to ANZ Personal Banking Account Fees and Charges (PDF) for fees and charges that apply.

ReturnANZ Online Saver account earns a standard variable rate of interest, which is subject to change.

ReturnANZ Online Saver is only available to customers who open or who are the account holders of, or signatories to, eligible ANZ everyday banking accounts with ANZ Internet Banking or ANZ Phone Banking access. Eligible accounts include ANZ Access Advantage, ANZ Access Basic, ANZ Pensioner Advantage, ANZ Progress Saver, ANZ V2 PLUS and ANZ Premium Cash Management Account. Terms and conditions and fees and charges apply to the eligible account. Monthly fees may apply to the linked account.

ReturnCustomers aged under 18 need to show proof of age at an ANZ branch in order to receive their transaction fees waiver. Fees and charges apply. Transactions can disqualify you from earning bonus interest on the account in the relevant period. Please refer to ANZ Personal Banking Account Fees and Charges (PDF) for fees and charges that apply and information about bonus interest qualification and earning requirements.

ReturnBonus interest is subject to eligibility. With an ANZ Progress Saver you can qualify for bonus interest (in addition to the current variable base interest) in respect of a particular month if the set minimum deposit (currently single deposit of $10) and no withdrawals, fees or charges occur in that month. Deposits, withdrawals, fees and charges are only taken to have occurred during a month if they have an effective date that is after the last business day of the previous month and on or before the last business day of that month. An effective date is a date we assign to the transaction in our system and may be different to the date when it occurred or when it was processed by our systems. If you qualify, you can generally earn bonus interest from the last business day of the previous month up to (but excluding) the last business day of the month but this may differ depending on the effective date of a transaction. Refer to ANZ Saving & Transaction Products Terms and Conditions for further details including what’s included in your balance, how interest is calculated and how we work out if you earn and qualify for bonus interest. Interest rates are variable and subject to change.

ReturnOne fee-free ANZ Transaction per month. Additional ANZ Transactions charged as: Electronic Transactions $1.00 each, Staff Assisted Transactions $2.50 each. ANZ Internet Banking transactions are free. ANZ Transactions, Electronic Transactions, Staff Assisted Transactions and Internet Banking Transactions are defined in the ANZ Personal Banking Account Fees and Charges (PDF) booklet. Any withdrawals in a particular month, including those that are free of charge, will disqualify you from bonus interest for that month.

ReturnDifferent interest rates apply to different investment amounts, terms and interest frequencies. Early withdrawal fees will apply and the account will incur an interest reduction in respect of the money withdrawn or transferred early. Rates are subject to change.

ReturnAn ANZ Advance Notice Term Deposit has a 31 day notice period and is a different product to an ANZ Term Deposit. This means that if you request an early withdrawal or transfer of all or part of your funds, the funds will not be provided until the 31st day after the request (or, where that is a non-business day, on or before the next business day). An administration fee of $30 will be charged and the account will incur an interest reduction in respect of the money withdrawn or transferred early in accordance with the ANZ Savings and Transaction Product Terms and Conditions (PDF). If you may have a need in the future to immediately withdraw or transfer funds, other deposit products may be more suitable for you.

ReturnIf you withdraw funds before the maturity date of a term deposit, an administration fee of $30 will be charged and the account will incur an interest reduction in respect of the money withdrawn or transferred early in accordance with the ANZ Saving and Transaction Terms and Conditions (PDF).

ReturnEarly withdrawal fees will apply. An administration fee of $30 will be charged and the account will incur an interest reduction in respect of the money you withdraw or transfer early. Refer to ANZ Saving & Transaction Products Terms and Conditions (PDF).

Return