Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

Life isn’t always flexible, but how you pay for it can be. ANZ Instalment Plans could be a handy way to repay your credit card purchases over 3, 6 or 12 months.disclaimer

Enjoy 0% p.a. interestdisclaimer on Instalment Plans for purchasesdisclaimer

Approval, eligibility criteria and T&Cs apply. Set up Fee applies.

Yeppity-yep-yep! Buy what you need now on your credit card and apply for an ANZ Instalment Plan on that purchase to get 0% p.a. interestdisclaimer on your repayments over 3, 6 or 12 months.disclaimer Bet that got your interest?

Approval, eligibility criteria and T&Cs apply. Setup Fees apply.

Purchase what you need and pay it off in Instalments.disclaimer Get up to 99 Plans at once and cancel anytime with no cancellation fee.disclaimer

Winning! You’ll continue to earn ANZ Reward or Qantas Points on your existing credit card the same way you do now.disclaimerdisclaimer

The ANZ App is where it’s at. Apply for an Instalment Plan and manage it from your existing credit card account in the ANZ App.

ANZ Instalment Plans are similar to Buy Now Pay Later services in that they allow you to buy now, repay later. Here are some key differences:

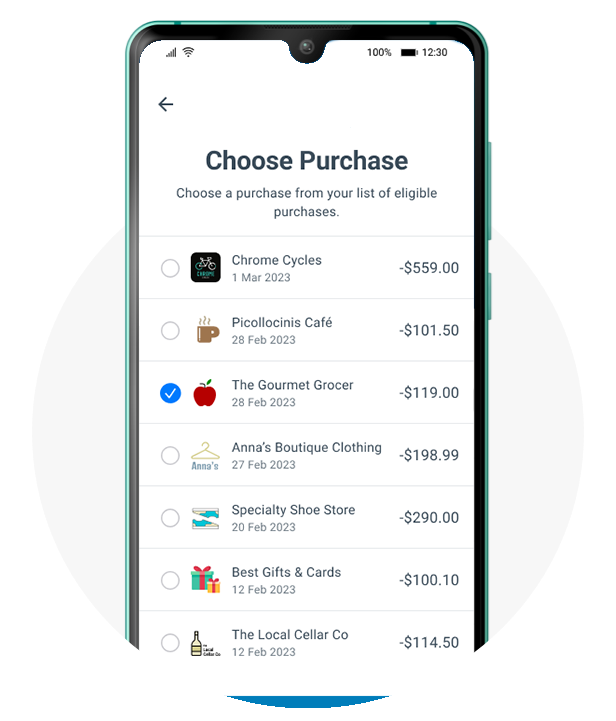

Choose an eligible purchase to put on an ANZ Instalment Plan.

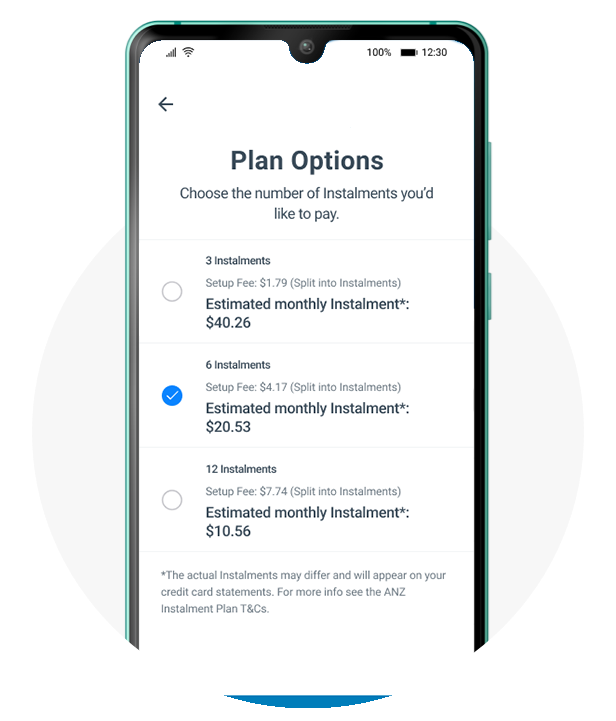

Choose from a 3, 6 or 12 month Instalment Plan. Review the Plan details and submit. Hey presto!

Applications are usually processed within two business days, and we’ll let you know if your Instalment Plan is approved. The Instalments will then form part of your Minimum Monthly Payments due on your credit card account, as indicated on your credit card statements.

For more information on ANZ Instalment Plans for a purchase, see the ANZ Instalment Plan Terms and Conditions (PDF). Approval, eligibility criteria and T&Cs apply.

3 month Instalment Plan |

1.5% of amount enrolled |

6 month Instalment Plan |

3.5% of amount enrolled |

12 month Instalment Plan |

6.5% of amount enrolled |

For example, if you bought a TV for $1,000 (incl GST) and enrolled it into a 3 month Instalment Plan for a purchase, you’d be charged a $15 Setup Fee payable over the term of the Plan, while enjoying 0% p.a. interest for the duration of the Plan.

That’s also possible. Apply for a 3, 6 or 12 month Instalment Plan on part of your balance and you could enjoy a lower interest ratedisclaimer compared to the standard interest rate on purchases.disclaimer

Approval, eligibility criteria, T&Cs and charges apply.

Applications for credit are subject to ANZ’s credit approval criteria. Terms and conditions, and fees and charges apply to your credit card.

Terms and Conditions and eligibility criteria apply to ANZ Instalment Plans. Read the ANZ Instalment Plan Terms and Conditions (PDF) and if approved, your confirmation communication for details. You can refer to your statements of account for information about the interest rate, fees, and/or charges that relate to a particular ANZ Instalment Plan.

The ANZ App is provided by Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Super and Insurance (if available) are not provided by ANZ but entities which are not banks. ANZ does not guarantee them. This information is general in nature only and does not take into account your personal objectives, financial situation or needs. ANZ recommends that you read the ANZ App Terms and Conditions available here for iOS (PDF) and here for Android (PDF) and consider if this service is appropriate to you prior to making a decision to acquire or use the ANZ App.

ANZ App for Android is only available on Google Play™. ANZ App for iPhone is only available from the App Store.

Apple, Apple Pay, Apple Watch, Face ID, iPad, iPhone and Touch ID are trade marks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Android, Google Play and the Google Play logo are trade marks of Google Inc.

T&Cs and eligibility criteria apply. Fees and charges may apply.

ReturnA Plan interest rate is a discounted purchase interest rate that applies to an ANZ Instalment Plan balance if and while it’s enrolled in a Plan. For more information, see the ANZ Instalment Plan T&Cs (PDF).

ReturnApproval, eligibility criteria, T&Cs and Setup Fee applies.

ReturnT&Cs apply to ANZ Instalment Plan cancellation. See the ANZ Instalment Plan T&Cs (PDF) for further info. When a cancellation is processed, the outstanding ANZ Instalment Plan balance will be moved to the Purchases balance on your Credit Card Account and may start to attract interest at the standard variable annual percentage interest rate on purchases applicable to that account. Refer to your Credit Card Contract and your statement of account for details of the rate(s) that apply to your Purchases balance. Interest rates are subject to change. If a Setup Fee applies to your ANZ Instalment Plan, ANZ will refund the Setup Fee within two ANZ Business Days of receiving your cancellation request, by crediting the Setup Fee to your Credit Card Account in accordance with the ANZ Credit Cards Conditions of Use (PDF), provided ANZ receives your request to cancel the Plan within 6 days of your ANZ Instalment Plan becoming active (being when the Plan is accepted by ANZ).

ReturnANZ Reward Points are earned and redeemed in the ANZ Rewards store in accordance with the ANZ Rewards – Rewards Program Terms and Conditions booklet (PDF). Certain transactions and other items are not eligible to earn Reward Points, for details refer to the ANZ Rewards – Rewards Program Terms and Conditions booklet (PDF).

ReturnQantas Points and Bonus Qantas Points are earned and redeemed in accordance with the ANZ Frequent Flyer Reward Terms and Conditions booklet (PDF) (please call 13 13 14 for a copy). Certain transactions and other items are not eligible to earn Qantas Points, for details refer to the ANZ Frequent Flyer Reward Terms and Conditions booklet (PDF). Account Holder must be a member of the Qantas Frequent Flyer program to earn and redeem Qantas Points. A joining fee may apply. Membership of the Qantas Frequent Flyer program is subject to the Terms and Conditions of the Qantas Frequent Flyer program. Earn rates and earn rate bands are subject to change. Existing customers should call 13 13 14 for information regarding their account. For details on using your Qantas Points please refer to the Qantas website.

ReturnANZ Falcon is a trademark of Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Falcon is a trademark of Fair Isaac Corporation.

ReturnNot all ANZ credit card accounts are eligible to apply to enrol an Amount in an ANZ Instalment Plan. If you are eligible to apply for a Plan you will see the option “ANZ Instalment Plans” in the “Manage” section of your credit card in the ANZ App.

ReturnStandard variable annual percentage interest rate on purchases for ANZ Low Rate is , for ANZ Rewards Classic, for ANZ Rewards Platinum, for ANZ Rewards Black, for ANZ Frequent Flyer, for ANZ Frequent Flyer Platinum and for ANZ Frequent Flyer Black. Rates are subject to change. Refer to your statement of account for details of the rate(s) that apply to your account.

ReturnT&Cs apply. You can learn more about the ANZ Instalment Plan T&Cs (PDF) here.

ReturnThe Setup Fee (if applicable) is an Instalment Plan Fee and will be calculated as a percentage of the Amount that’s enrolled in the ANZ Instalment Plan at the time the balance is enrolled.

ReturnExcluding any repayments on Promotional Plans not yet due.

Return