-

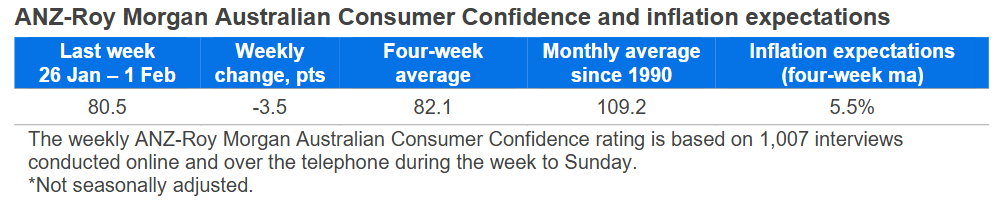

Consumer confidence fell 3.5 points last week to 80.5 points. The four-week moving average eased 0.3 points to 82.1 points.

‘Weekly inflation expectations’ ticked up 0.1 percentage point to 5.5 per cent, while the four-week moving average was unchanged at 5.5 per cent.

'Current financial conditions’ (over the last year) declined 7.5 points, while ‘future financial conditions’ (next 12 months) decreased 2.7 points.

‘Short-term economic confidence’ (next 12 months) was down 4.7 points, and ‘medium-term economic confidence’ (next five years) rose 1.4 points.

The ‘time to buy a major household item’ subindex dropped 4.2 points.

"Consumer Confidence fell 3.5 points to 80.5 points last week. Households are feeling less optimistic about their personal finances, with the ‘future financial conditions’ subindex at its lowest level since late November 2023 (soon after the RBA increased the cash rate to 4.35 per cent)," ANZ Economist, Sophia Angala said.

"The tick up in weekly inflation expectations and the broad-based decline in confidence may have been influenced by discussion of a potential rate hike ahead of this week’s RBA meeting. This follows the release of Q4 2025 inflation data, which showed the trimmed mean measure, the RBA’s preferred measure of underlying inflation, came in higher than the RBA’s expectations."

For media enquiries contact:

Judy Hang

Communications Associate

Tel: +61 0479 173 821

anzcomau:newsroom/mediacentre/ANZ-Roy-Morgan-Consumer-Confidence

Consumer confidence falls after Q4 CPI

2026-02-03

/content/dam/anzcomau/mediacentre/images/consumerconfidence/ImagesTiles/blue bag.jpg