-

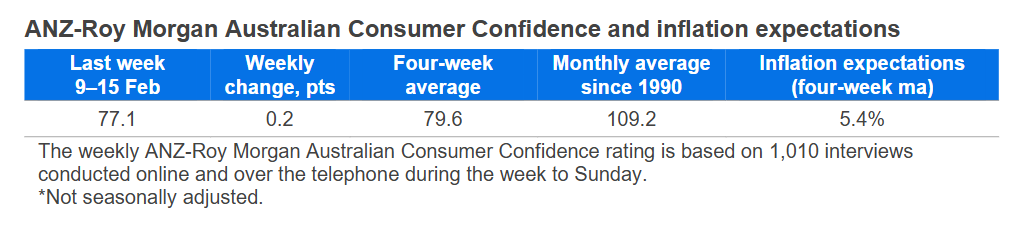

Consumer confidence rose 0.2 points last week to 77.1 points. The four-week moving average fell 0.6 points to 79.6 points.

‘Weekly inflation expectations’ increased 0.5 percentage point to 5.5 per cent, while the four-week moving average was unchanged at 5.4 per cent.

‘Current financial conditions’ (over the last year) lifted 3.3 points, while ‘future financial conditions’ (next 12 months) decreased 1.2 points.

‘Short-term economic confidence’ (next 12 months) ticked up 0.2 points, and ‘medium-term economic confidence’ (next five years) was down 0.7 points.

The ‘time to buy a major household item’ subindex eased 0.5 points.

"ANZ-Roy Morgan Australian Consumer remains very weak at 77.1 points, having dropped 3.4 points since the RBA increased the cash rate to 3.85 per cent.," ANZ Economist, Sophia Angala said.

"The four-week moving average fell to its lowest level since June 2024. Households remain pessimistic in their financial conditions over the next 12 months and their economic conditions over the next five years, with both subindices at decade lows.

"We now expect modest GDP growth of 1.8 per cent year on year through 2026. The weaker level of consumer confidence following the February RBA rate hike is likely to dampen household consumption growth and support this soft result in the near term."

For media enquiries contact:

Siobhan Jordan

Senior External Communications Manager

Tel: +61 403 988 326

anzcomau:newsroom/mediacentre/ANZ-Roy-Morgan-Consumer-Confidence

Consumer confidence is weak

2026-02-17

/content/dam/anzcomau/mediacentre/images/consumerconfidence/ImagesTiles/blue bag.jpg