Fraud protection.

Now it’s personal.

ANZ Falcon® technology monitors millions of transactions every day to help keep you safe from fraud.

Falcon® is a registered trademark of Fair Isaac Corporation.

![]()

ANZ Falcon® fraud detection technology, biometrics monitoring and our team of security specialists work 24/7 to help safeguard your money, and protect you from fraud.

Want to know more?

![]()

Easy, secure access to your money for all your day-to-day payments, purchases and bills.

A credit card with a low ongoing interest rate for your everyday purchases.

Get started in just 5 minutes. Apply for pre-approval, a new home loan, refinance or top up your existing ANZ home loan.

![]()

![]()

Soften the impact of rising living costs with saving strategies and budgeting tips to keep on top of your finances. Or, if you're looking to save for a rainy day, take a look at our term deposit and savings accounts.

What is inflation and how does it affect you?

Get a fixed return with a term deposit account

How to manage money as a couple

Save like a pro. Try our savings calculator

ANZ Progress Saver. Buddy up to bonus interest

Facing financial difficulty? Let us help you

![]()

![]()

![]()

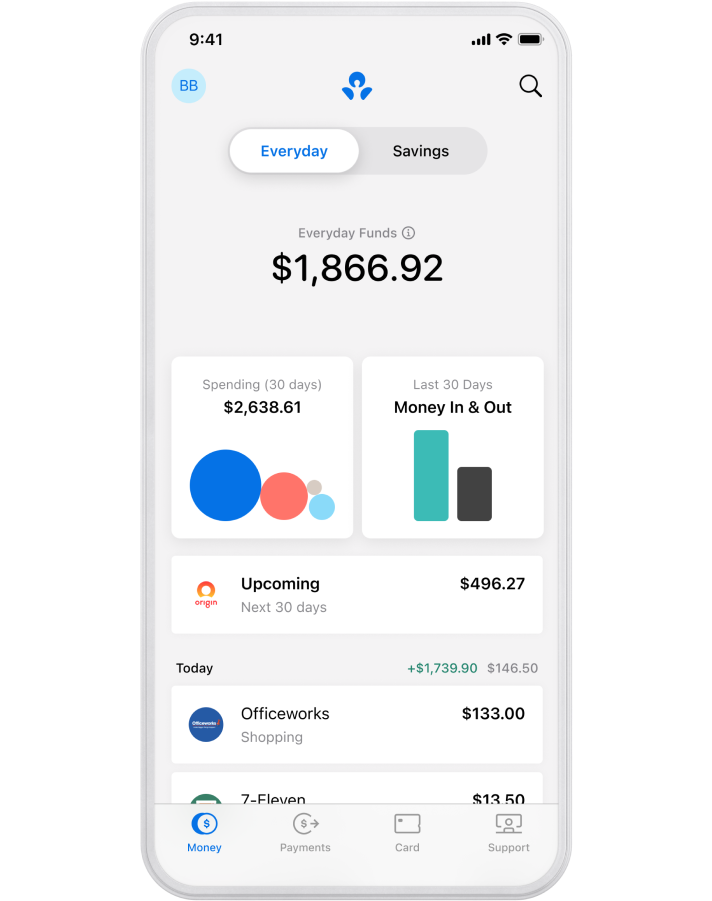

The ANZ Plus app is packed with smart money management tools designed to help you spend less and save more. When you download the ANZ Plus app and join you can:

When you download the ANZ Plus app and join you'll be opening ANZ Plus and Save accounts. To access other ANZ accounts, you can use the ANZ App.

![]()

![]()

Need a hand with online banking, PayID®disclaimer or digital wallets? Or help with a product or service of ours? If it’s support you’re after, you'll find it here.

Pay on the go with your phone or wearable

International payments and overseas travel

Compare our latest interest rates and fees

Accessibility and inclusivity for our customers

Advice does not take into account your personal needs, financial circumstances or objectives. Please consider if it is appropriate for you and read the terms and conditions, Product Disclosure Statement and Financial Services Guide before acquiring any product. See ANZ Plus Terms & Conditions for ANZ Plus and ANZ Save accounts. Applications for credit subject to approval. Terms and conditions available on application. Fees and charges apply.

The ANZ App is provided by Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522. Super and Insurance (if available) are not provided by ANZ but entities which are not banks. ANZ does not guarantee them. This information is general in nature only and does not take into account your personal objectives, financial situation or needs. ANZ recommends that you read the ANZ App Terms and Conditions available here for iOS (PDF) and here for Android (PDF) and consider if this service is appropriate to you prior to making a decision to acquire or use the ANZ App.

Images and features shown are iOS versions. Feature availability and design may differ based on the device, operating system, or ANZ Plus app version.

“ANZ Smart Choice Super” is a suite of products consisting of ANZ Smart Choice Super and Pension (PDF), ANZ Smart Choice Super for employers and their employees (PDF) and ANZ Smart Choice Super for QBE Management Services Pty Ltd and their employees (PDF). OnePath Custodians Pty Limited (ABN 12 008 508 496, AFSL 238346 RSE L0000673) (OPC) is the issuer of the ANZ Smart Choice Super suite of products. OPC is the trustee of the Retirement Portfolio Service (ABN 61 808 189 263, RSE R1000986) (RPS) and the ANZ Smart Choice Super suite of products are part of the RPS. You should consider obtaining financial advice before making any decisions based on the information. You should obtain a Product Disclosure Statement (PDS) relating to the relevant financial product and consider it before making any decision about whether to acquire or continue to hold the product. Target Market Determinations (TMDs) where required for relevant products have to be available for consideration by distributors/members. A copy of the PDS and TMD (where relevant) is available via the links above, and upon request by phoning 13 12 87 or by searching for the applicable product at www.anz.com/smartchoicesuper. The ANZ Smart Choice Super and Pension product is distributed by Australia and New Zealand Banking Group Limited (ANZ) (ABN 11 005 357 522). We recommend that you read the ANZ Financial Services Guide (PDF), before deciding whether to acquire or continue to hold this product. View the ANZ Smart Choice Super and Pension Target Market Determination (PDF). ANZ Smart Choice Super for employers and their employees and ANZ Smart Choice Super for QBE Management Services Pty Ltd and their employees are MySuper compliant products issued pursuant to the latest PDS available at www.anz.com/smartchoicesuper. OPC is a member of the Insignia Financial group of companies, comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group). The Australia and New Zealand Banking Group Limited (ANZ) (ABN 11 005 357 522) brand is a trademark of ANZ and is used by OPC under licence from ANZ. ANZ and the Insignia Financial group of companies (including OPC) are not related bodies corporate. ANZ does not stand behind or guarantee these products. Before re-directing your super or moving your money into ANZ Smart Choice Super, you will need to consider whether there are any adverse consequences for you, including loss of benefits (e.g. insurance cover), investment options and performance, functionality, increase in investment risks and where your future employer contributions will be paid.

Falcon® is a registered trademark of Fair Isaac Corporation.

For ANZ Standard Variable rates the applicable discount from the index rate is 1.20% p.a. for loans with a Loan to Value Ratio (LVR) of greater than 80% and 1.40% p.a. for loans with a LVR 80% or less. Further discounts may be available on standard variable rate loans dependent on your LVR which is determined by the size of your deposit or equity position. Equity in your home is calculated as the difference between the value of your home and the amount you have left to pay on your home loan at the time the calculation is performed. Property value is ANZ's valuation of the security property and may be different to the price you pay for a property. Eligibility criteria applies to the Special Offer discount for ANZ Simplicity PLUS, including $50,000 or more in new or additional ANZ lending. Offers can be withdrawn or changed anytime.

ReturnOther home loan fees including Late Payment Fee, Lock Rate Fee, Early Repayment Cost (Fixed Rate Loans) and ANZ Equity Manager facility fee still apply. Loan security fees including Lodgement Fee, Production Fee, Settlement Fee and Search Fee still apply however will not be charged on establishment of a loan. Government fees and charges (including government search fees and stamp duty) may still apply.

ReturnDifferent interest rates apply to different investment amounts, terms and interest frequencies. Rates current as at and are subject to change. Early withdrawal fees will apply and the account will incur an interest reduction in respect of the money withdrawn or transferred early. Refer to ANZ Saving and Transaction Terms and Conditions (PDF). At maturity we will reinvest your ANZ Advance Notice Term Deposit based on the reinvestment consent you have given us and in accordance with instructions you have provided. If you choose to reinvest your principal (and interest) at the end of the investment term, the interest rate applicable to your ANZ Advance Notice Term Deposit may be lower than the interest rate on your maturing ANZ Advance Notice Term Deposit. If your circumstances change or this product is no longer suitable for you, please contact ANZ at or prior to maturity, or within your 7 day grace period (following reinvestment) to make alternative arrangements.

ReturnA single interest rate applies to and is determined by the balance of your ANZ Save account (see here for more about what’s included in your balance). A lower rate will apply across your entire ANZ Save balance if it is $250,000 or more. You can earn interest this way until 1st September 2024, after which additional criteria will apply that may affect how much interest you earn. Interest is calculated daily, paid monthly and rates are subject to change.

ReturnPayID is a registered trademark of NPP Australia Limited.

ReturnA minimum deposit of $5,000 is required to open an ANZ Advance Notice Term Deposit or an ANZ Term Deposit. This calculator has been set to a maximum deposit of $4,999,999. However, investments of $100,000 or more may be subject to different interest rates than those provided in this calculator. Please call 13 33 33 or visit your nearest ANZ Branch to discuss your term and interest rate for an investment of $100,000 or more.

ReturnEarly withdrawal fees will apply. An administration fee of $30 will be charged and the account will incur an interest reduction in respect of the money withdrawn or transferred early. An ANZ Advance Notice Term Deposit has a 31 day notice period. This means that if you request an early withdrawal or transfer of all or part of your funds, the funds will not be provided until the 31st day after the request (or, where that is a non-business day, on or before the next business day). Refer to the ANZ Saving and Transaction Products Terms and Conditions (PDF 746kB) for further details.

ReturnInterest rates current as at and subject to change at any time. Different interest rates apply to each term deposit product and to different investment amounts, term lengths and interest frequencies. Early withdrawal fees may apply. Certain rates do not qualify for additional bonus interest rates and are not available in conjunction with any other bonus or special interest rate offer. For Advance Notice Term Deposits, this applies to investment terms of 3, 4, 6, 9, 11 and 12 months, as well as all term lengths of greater than 12 months. For Term Deposits, this applies to investment terms of 3, 6, 9 and 12 months as well as all term lengths of greater than 12 months.

ReturnThe principal difference between an ANZ Advance Notice Term Deposit and an ANZ Term Deposit (apart from the interest rate that applies) is that you must provide 31 days’ notice to ANZ if you wish to make an early withdrawal or transfer of all or part of your funds from an ANZ Advance Notice Term Deposit account. Further details are set out in ANZ Saving and Transaction Products Terms and Conditions (PDF 746kB).

ReturnProvided the cardholder didn’t contribute to the loss and notified ANZ promptly of the fraud.

ReturnDeposits are protected up to a limit of $250,000 for each account holder under the FCS scheme.

ReturnMonthly account service fee waiver applicable to ANZ Access Advantage accounts if you deposit $2,000 or more by the last business day of the calendar month. You must satisfy the monthly deposit requirement to be eligible for the waiver in a particular month.

ReturnOn application for the waiver by an eligible customer, the monthly account service fee will be waived on one nominated ANZ Access Advantage account. For more information on Exemptions and Concessions please refer to ANZ Personal Banking Account Fees and Charges (PDF).

ReturnTerms and conditions apply. No transaction fee access relates to the following: a successful cash withdrawal and an account balance query. Daily withdrawal limits may apply. For certain ANZ cards, withdrawals from an ATM may attract interest, and you may also have to pay a cash advance fee. For details on cash advance fees, transactions that are considered to be a ‘cash advance’ and other charges, please refer to your applicable product terms and conditions. Eligibility criteria, account fees and interest, charges may apply. Visit anz.com for more information.

ReturnAvailable when the sending and receiving accounts are capable of processing faster payments. Not available on some ANZ accounts, including ANZ Home Loans and ANZ Personal Loans. Technical interruptions may occur.

ReturnA daily limit of $1,000 applies for Pay Anyone payments in the ANZ App. Higher payment limits may be available if you have registered for and use Voice ID and it is available on your device. A daily Pay Anyone limit of between $1,000 to $10,000 applies in Internet Banking. A higher limit may be available with ANZ Shield. Recipients require an account with an Australian financial institution to receive or collect Pay Anyone payments. Terms and conditions apply, view them at anz.com/app.

ReturnMobile payments available on compatible devices and eligible ANZ cards.

Separate terms and conditions apply to the use of Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay.

Apple, Apple Pay and iPhone are trade marks of Apple Inc., registered in the U.S. and other countries.

Android, Google Pay, and the Google Logo are trademarks of Google LLC.

Samsung and Samsung Pay are trademarks or registered trademarks of Samsung Electronics Co., Ltd.

Fitbit and the Fitbit logo are trademarks or registered trademarks of Fitbit, Inc. in the U.S. and other countries.

Garmin, the Garmin logo, and the Garmin delta are trademarks of Garmin Ltd. or its subsidiaries and are registered in one or more countries, including the U.S. Garmin Pay is a trademark of Garmin Ltd. or its subsidiaries.

ReturnProvided you didn’t contribute to the loss, you let us know as soon as you found out about the loss and you have complied with the Electronic Banking Conditions of Use contained in your product terms and conditions.

ReturnOther ownership structures may be available.

ReturnDebit interest may apply. Please refer to ANZ Personal Banking Account Fees and Charges (PDF).

ReturnPlease refer to ANZ Personal Banking Account Fees and Charges (PDF) for fees and charges that apply.

ReturnOpen your first ANZ Online Saver account and you'll receive an introductory fixed bonus rate of % p.a. for 3 months, on top of the ANZ Online Saver standard variable rate (currently ). After 3 months, the ANZ Online Saver standard variable rate, applicable at that time, will apply. The introductory fixed bonus rate is only available on the first ANZ Online Saver account opened by customers who have not held an ANZ Online Saver in the last 6 months. In case of joint account holders, the introductory fixed bonus rate offer will only be received if all customers are eligible.

ReturnANZ Online Saver is only available to customers who open or who are the account holders of, or signatories to, eligible ANZ everyday banking accounts with ANZ Internet Banking or ANZ Phone Banking access. Eligible accounts include ANZ Access Advantage, ANZ Access Basic, ANZ Pensioner Advantage, ANZ Progress Saver, ANZ V2 PLUS and ANZ Premium Cash Management Account. Terms and conditions and fees and charges apply to the eligible account.

ReturnCustomers aged under 18 need to show proof of age at an ANZ branch in order to receive their transaction fees waiver. Fees and charges apply. Please refer to ANZ Personal Banking Account Fees and Charges (PDF) for fees and charges that apply.

ReturnBonus interest is subject to eligibility. ANZ Progress Saver pays bonus interest (in addition to the current variable base interest) in respect of a particular month if the set minimum deposit (currently $10) and no withdrawals, fees or charges are processed to the account on or before the last business day of that calendar month, and after the last business day of the previous calendar month. Bonus and base rates are variable and subject to change.

ReturnOne fee-free ANZ Transaction per month. Additional ANZ Transactions charged as: Electronic Transactions $1.00 each, Staff Assisted Transactions $2.50 each. ANZ Internet Banking transactions are free. ANZ Transactions, Electronic Transactions, Staff Assisted Transactions and Internet Banking Transactions are defined in the ANZ Personal Banking Account Fees and Charges (PDF) booklet. Any withdrawals in a particular month, including those that are free of charge, will disqualify you from bonus interest for that month.

ReturnDifferent interest rates apply to different investment amounts, terms and interest frequencies. Early withdrawal fees will apply and the account will incur an interest reduction in respect of the money withdrawn or transferred early. Rates current as at and are subject to change.

ReturnAn ANZ Advance Notice Term Deposit has a 31 day notice period. This means that if you request an early withdrawal or transfer of all or part of your funds, the funds will not be provided until the 31st day after the request (or, where that is a non-business day, on or before the next business day). An administration fee of $30 will be charged and the account will incur an interest reduction in respect of the money withdrawn or transferred early in accordance with the ANZ Savings and Transaction Product Terms and Conditions (PDF). If you may have a need in the future to immediately withdraw or transfer funds, other deposit products may be more suitable for you.

ReturnIf you withdraw funds before the maturity date of a term deposit, an administration fee of $30 will be charged and the account will incur an interest reduction in respect of the money withdrawn or transferred early in accordance with the ANZ Saving and Transaction Terms and Conditions (PDF).

ReturnEarly withdrawal fees will apply. An administration fee of $30 will be charged and the account will incur an interest reduction in respect of the money you withdraw or transfer early. Refer to ANZ Saving & Transaction Products Terms and Conditions (PDF).

Return